Introduction

The share market stands as the cornerstone of modern wealth creation, transforming ordinary Indians into successful investors and business owners. This marketplace represents far more than numbers flickering on screens—it’s a sophisticated ecosystem where dreams of financial independence become reality through strategic participation in India’s most successful companies.

- Introduction

- What is Share Market: Understanding the Fundamentals

- Historical Evolution of Indian Share Markets

- Primary vs Secondary Market Structure

- Types of Securities and Investment Instruments

- Investment Analysis: Fundamental vs Technical Approach

- Key Financial Metrics for Stock Analysis

- How to Start Investing: Complete Step-by-Step Process

- Top Stock Brokers in India for 2025

- Investment Strategies for Different Goals

- Diversification and Asset Allocation Strategy

- Understanding and Managing Market Risks

- Common Investment Mistakes and How to Avoid Them

- IPO Investment: Participating in New Opportunities

- Essential Stock Market Terminology

- Taxation of Share Market Investments

- Building Your Investment Portfolio: Beginner to Advanced

- The Power of Compounding in Share Market

- Benefits and Wealth Creation Potential

- Regulatory Framework and Investor Protection

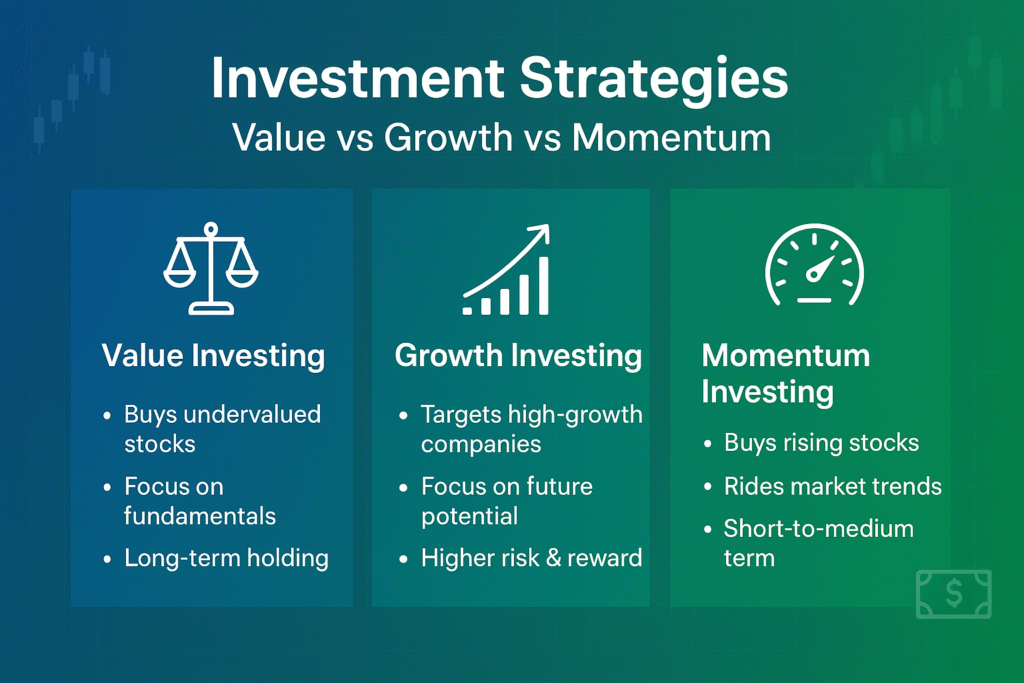

- Investment Strategies: Value vs Growth vs Momentum

- How the Share Market Works

- Conclusion

- FAQ

- Disclaimer

Have you ever wondered how middle-class families build extraordinary wealth and create generational prosperity? The answer lies in understanding what the share market truly represents: a gateway to ownership in India’s economic growth story and a proven path to long-term financial freedom.

What is Share Market: Understanding the Fundamentals

What is share market in its simplest form? The share market, also known as the stock market, is a regulated marketplace where shares of publicly listed companies are bought and sold. When you purchase shares, you become a fractional owner of that business, entitled to a proportionate share of its profits and certain voting rights in corporate decisions.

This sophisticated platform serves as a vital bridge connecting businesses seeking capital for growth with investors looking to build wealth through strategic ownership participation. The market transforms ordinary individuals into business stakeholders, allowing them to benefit directly from economic growth and corporate success.

| Key Market Components | Description | Function |

|---|---|---|

| Primary Market | Initial share issuance | Companies raise capital through IPOs |

| Secondary Market | Trading between investors | Provides liquidity and price discovery |

| Stock Exchanges | Trading platforms | Facilitate secure transactions |

| Regulatory Framework | SEBI oversight | Ensures transparency and investor protection |

Historical Evolution of Indian Share Markets

India’s share market journey began in 1875 with the establishment of the Bombay Stock Exchange (BSE), making it Asia’s oldest stock exchange. This historic institution started under a banyan tree where stockbrokers gathered to trade securities, eventually evolving into the sophisticated electronic trading platform we know today.

The National Stock Exchange (NSE) was founded in 1992 to bring transparency and electronic trading to Indian markets. NSE revolutionized Indian trading by introducing automated systems and becoming the first exchange in the country to offer electronic trading facilities.

Today, these exchanges dominate the Indian equity landscape, with BSE hosting over 5,500 listed companies and NSE featuring approximately 1,500 companies. The combined market capitalization exceeds ₹90 lakh crores, reflecting the enormous scale and importance of these institutions in answering what is share market’s role in India’s economy.

| Exchange | Established | Key Index | Listed Companies | Specialization |

|---|---|---|---|---|

| BSE | 1875 | Sensex (30 companies) | 5,500+ | Broad market representation |

| NSE | 1992 | Nifty 50 | 1,500+ | Electronic trading, derivatives |

Primary vs Secondary Market Structure

The Indian share market consists of two distinct segments: the primary market and the secondary market, each serving a unique purpose in the investment ecosystem.

The primary market is where companies issue new shares to investors via Initial Public Offerings (IPOs), raising capital for growth and expansion. When Zomato or Paytm launched their IPOs, they were utilizing the primary market to raise funds directly from investors.

The secondary market is where previously issued shares are traded among investors, with prices fluctuating daily based on supply and demand. This is where your regular trading activities occur when buying and selling shares through NSE and BSE platforms.

| Market Type | Role | Example |

|---|---|---|

| Primary Market | Companies issue new shares to investors via IPOs; capital raised for growth | Zomato IPO, Paytm IPO |

| Secondary Market | Previously issued shares are traded among investors; prices fluctuate daily | Shares bought/sold on NSE, BSE platforms |

Types of Securities and Investment Instruments

Understanding what is share market requires knowledge of various securities available for investment. The market offers multiple investment instruments, each designed to meet different investor needs and risk preferences.

Equity securities represent ownership stakes in companies. Common stocks are the most prevalent form, offering shareholders voting rights, dividend potential, and capital appreciation opportunities. These securities provide direct ownership in companies, making investors partners in business success and growth.

Preferred stocks offer a middle ground between stocks and bonds, typically providing fixed dividend payments and priority over common shareholders during liquidation. While they generally don’t include voting rights, preferred shares offer more predictable income streams.

Debt securities include corporate bonds, which represent loans to companies offering regular interest payments and principal repayment at maturity. Government bonds represent the safest debt securities, backed by sovereign guarantee and offering stable returns.

| Category | Description | Rights & Benefits |

|---|---|---|

| Equity Shares | Most common; carry voting rights and dividends | Ownership, voting, profit participation |

| Preference Shares | Priority dividend payouts, no/limited voting rights | Fixed dividends, liquidation preference |

| Bonus Shares | Issued free to existing shareholders from company profits | Free additional ownership |

| Rights Shares | Offered to existing shareholders at special price before open offer | Preferential buying opportunity |

| Corporate Bonds | Loans to companies with regular interest | Fixed income, no ownership |

| Government Bonds | Sovereign-backed debt securities | Guaranteed returns, capital protection |

Investment Analysis: Fundamental vs Technical Approach

Understanding both analysis types helps investors make informed decisions when exploring what is share market investment strategies.

Fundamental analysis evaluates securities by examining their intrinsic value through economic and financial factors. This approach involves analyzing company financial health through income statements, balance sheets, and cash flow statements. It considers industry position, competitive advantages, management quality, and macroeconomic factors affecting the business.

Technical analysis focuses on statistical trends in stock prices and trading volumes. This approach examines price patterns, technical indicators like moving averages, market psychology through price action, and support and resistance levels for entry and exit timing.

| Approach | Focus | Best For | Key Elements |

|---|---|---|---|

| Fundamental | Business financials, growth prospects | Long-term investors | Earnings, industry position, management, market conditions |

| Technical | Price trends, statistical analysis, trading volume | Short-term traders | Price patterns, technical indicators, support/resistance |

Key Financial Metrics for Stock Analysis

Mastering financial metrics is essential for understanding what is share market investment evaluation. These metrics help investors analyze stocks comprehensively and make informed decisions.

The Price-to-Earnings (P/E) ratio is calculated as Market Price divided by Earnings per Share (EPS), helping determine if a stock is undervalued or overvalued. A high P/E ratio might indicate growth expectations or overvaluation, while a low P/E could suggest undervaluation or poor future prospects.

Earnings Per Share (EPS) reveals how much profit each outstanding share has earned, calculated by dividing net income by total outstanding shares. Dividend Yield shows the percentage return from dividends alone, calculated as Dividends per Share divided by Stock Price.

| Metric | Formula/Meaning | Importance |

|---|---|---|

| P/E Ratio | Market Price / EPS | Determines if stock is undervalued or overvalued |

| Earnings Per Share | Net Income / Outstanding Shares | Measures profitability per share |

| Dividend Yield | Dividends per Share / Stock Price | Shows dividend income potential |

| Market Cap | Share Price × Total Shares Outstanding | Indicates company’s public valuation |

| Return on Equity (ROE) | Net Income / Shareholder’s Equity | Measures how effectively equity is used for profit |

How to Start Investing: Complete Step-by-Step Process

Starting your journey in understanding what is share market practically requires following systematic steps for hassle-free entry into the Indian share market.

Begin by opening essential accounts: a bank account for fund transfers, a Demat account to store securities electronically, and a trading account to connect with stock exchanges through brokers. You’ll need KYC documents including PAN card, Aadhaar card, photographs, bank details, and address proof.

Choose the right broker by comparing costs, usability, features, and research tools. Fund your account by transferring money from your bank account to your trading account. Finally, research and select stocks based on your investment strategy before placing your first orders.

| Step | Details | Requirements |

|---|---|---|

| 1. Bank Account | Mandatory for fund transfers and investment proceeds | Existing savings account |

| 2. Demat Account | Stores securities in electronic form; required for all listed shares/trading | SEBI-registered DP |

| 3. Trading Account | Connects investor to stock exchanges via broker for buying/selling shares | SEBI-registered broker |

| 4. KYC Documents | Identity and address verification | PAN, Aadhaar, Photos, Bank Details, Address Proof |

| 5. Broker Choice | Compare top brokers for costs, usability, and features | Research and comparison |

| 6. Fund Account | Transfer funds to your trading account | Net banking or UPI |

| 7. Place Orders | Research, select stocks, and place buy/sell instructions | Broker’s trading platform |

Top Stock Brokers in India for 2025

Choosing the right brokerage is crucial for maximizing returns and trading efficiency when learning what is share market investment practically.

| Broker | USP | Ideal For | Key Features |

|---|---|---|---|

| Zerodha | Low brokerage, Kite platform | Active traders, cost-cutters | Flat ₹20 brokerage for F&O |

| Groww | User-friendly, education | Beginners, first-timers | Comprehensive educational resources |

| Angel One | Extensive research, range | Research-driven investors | Research-backed insights |

| Upstox | Mobile experience | Smartphone investors | Seamless mobile app |

| HDFC Securities | Full-service, reliability | Conservative investors | Extensive research reports |

Investment Strategies for Different Goals

Understanding what is share market strategies helps tailor your portfolio for personal objectives and risk tolerance.

Long-term investing involves holding shares for 3-10+ years, focusing on compound growth through reinvestment of dividends and capital appreciation. This strategy works best for retirement planning and major financial goals, utilizing blue-chip stocks and index funds.

Short-term investing involves trading for weeks or months, seeking quick returns through market volatility. This strategy requires more active management and suits investors seeking immediate cash flow opportunities, often using penny stocks and active trading.

Diversified portfolio strategy involves mixing asset classes and sectors to reduce risk while maintaining growth potential. This approach suits all investors and utilizes multi-cap and thematic funds for balanced exposure.

| Strategy | Description | Best For | Example Products |

|---|---|---|---|

| Long-Term Investing | Holding for 3–10+ years; focus on compound growth | Retirement, goals | Blue chips, Index funds |

| Short-Term Investing | Trading for weeks/months, seeking quick returns | Cashflow, opportunists | Penny stocks, active trading |

| Diversified Portfolio | Mix of asset classes and sectors to reduce risk | All investors | Multi-cap, thematic funds |

Diversification and Asset Allocation Strategy

Effective diversification is key to managing risk when understanding what is share market portfolio construction. Spreading investments across different asset classes, market capitalizations, sectors, and geographic regions helps optimize risk-return profiles.

A well-balanced portfolio should include equity shares for growth and wealth creation, debt funds for stability and fixed income, gold and commodities as hedge against inflation, and cash or liquid assets for emergency needs and liquidity.

| Asset Class | Role in Portfolio | Example Allocation (Beginners) | Purpose |

|---|---|---|---|

| Equities (Shares) | Growth, wealth creation | 50–70% | Capital appreciation |

| Debt Funds | Stability, fixed income | 20–35% | Regular income, stability |

| Gold/Commodities | Hedge against inflation | 5–10% | Portfolio protection |

| Cash/Liquid Assets | Emergency, liquidity | 5–10% | Immediate access |

Understanding and Managing Market Risks

Investors face several types of risks when exploring what is share market investment, which can be managed with appropriate strategies.

Market risk affects all investments simultaneously and cannot be eliminated through diversification. Economic downturns, interest rate changes, inflation, and geopolitical events create systematic risks impacting entire markets. The 2020 COVID-19 pandemic exemplified this risk type.

Company-specific risks relate to individual company performance and can be mitigated through diversification. Poor management decisions, competitive pressures, financial leverage, or industry-specific challenges represent unsystematic risks affecting particular companies or sectors.

| Risk Type | Description | Risk Mitigation | Impact Level |

|---|---|---|---|

| Market Risk | Losses due to market fluctuations (systematic) | Diversification, SIP | Market-wide |

| Company Risk | Poor management, fraud, declining business | Research, position limits | Company-specific |

| Liquidity Risk | Difficulty selling shares at the right price | Prefer high-volume stocks | Variable |

| Political/Regulatory | Policy changes, taxation, regulations affecting prices | Stay updated, diversify | Sector-specific |

Common Investment Mistakes and How to Avoid Them

Understanding what is share market pitfalls helps investors avoid costly errors that can derail their wealth-building journey.

Following tips blindly without research leads to losses from investing in poor businesses. Always conduct thorough research before investing in any stock. Emotional trading results in panic selling during downturns and greed-driven buying at peaks. Stick to your predetermined investment strategy regardless of market emotions.

Lack of diversification exposes portfolios to high losses if specific sectors underperform. Always diversify across different asset classes and sectors. Ignoring transaction costs allows brokerage fees to eat into returns. Choose low-cost brokers and limit excessive turnover.

| Mistake | Consequence | How to Avoid |

|---|---|---|

| Following Tips Blindly | Losses due to poor businesses | Research every stock before investing |

| Emotional Trading | Panic selling, missed opportunities | Stick to your strategy |

| Lack of Diversification | High losses if sector underperforms | Always diversify |

| Ignoring Costs | Brokerage eats into returns | Choose low-cost brokers, limit turnover |

| Trying to Time Market | Miss big rallies or buy high/sell low | Focus on discipline, SIP investment |

| Unclear Objectives | Random, scattered portfolio | Define goals and track progress |

IPO Investment: Participating in New Opportunities

Understanding what is share market IPO participation provides opportunities to invest in emerging companies from their public debut.

Initial Public Offerings represent companies offering shares to the public for the first time. Research involves studying the Red Herring Prospectus and checking the business model thoroughly. Application methods include ASBA via net-banking and UPI through broker apps.

Apply before IPO closing dates and monitor allotment announcements. Successful applicants receive shares in their Demat accounts. Remember that not all IPOs become profitable immediately, making research crucial for success.

| Step | Description | Key Points |

|---|---|---|

| Research | Study Red Herring Prospectus, check business model | Evaluate fundamentals thoroughly |

| Application Methods | ASBA via net-banking, UPI with broker app | Multiple convenient options |

| Timing | Apply before IPO closes; check allotment dates | Follow application deadlines |

| Allotment | Shares credited to your Demat account if successful | Wait for official confirmation |

| Risks | Not all IPOs are profitable immediately; do research | Due diligence essential |

Essential Stock Market Terminology

Mastering key terminology enhances understanding of what is share market communications and concepts.

A Demat account provides digital storage for shares and securities, while a trading account facilitates buy and sell orders in the market. Bull markets represent prolonged rises driven by optimism, while bear markets indicate extended periods of falling prices and negative sentiment.

Blue chip stocks represent stable, market-leading companies with sound track records. Market capitalization indicates total company valuation based on share price multiplied by total outstanding shares.

| Term | Meaning | Context |

|---|---|---|

| Demat Account | Digital storage for your shares/securities | Account management |

| Trading Account | Facilitates buy/sell orders in market | Transaction execution |

| Bull Market | Prolonged market rise driven by optimism | Market conditions |

| Bear Market | Extended period of falling prices and negative sentiment | Market conditions |

| Blue Chip Stocks | Stable, market-leading companies with sound track records | Stock categories |

| Market Capital | Total valuation based on share price × total shares | Company valuation |

| Dividend | Profit paid to shareholders, usually annually or as declared by company | Income component |

| Volatility | Frequency and magnitude of price fluctuations | Risk measurement |

| SEBI | Market regulator; protects investors, ensures transparency | Regulatory framework |

| SIP | Systematic Investment Plan—fixed amount invested routinely | Investment method |

Taxation of Share Market Investments

Understanding tax implications is crucial when learning what is share market investment returns calculation.

Equity shares held for less than one year attract short-term capital gains tax of 15%, while those held for more than one year attract long-term capital gains tax of 10% on gains exceeding ₹1 lakh. Mutual funds follow similar taxation patterns.

Dividend income from all investments is taxed according to individual income tax slab rates. Debt funds face different taxation, with both short-term and long-term gains taxed at applicable slab rates.

| Asset Type | Short-term Gains | Long-term Gains | Dividend Taxation |

|---|---|---|---|

| Equity Shares | 15% (sold <1 yr) | 10% on gains >₹1L (sold >1 yr) | Taxed per your income slab |

| Mutual Funds (Equity) | 15% (sold <1 yr) | 10% on gains >₹1L (sold >1 yr) | Taxed per your income slab |

| Debt Funds | Slab rate | Slab rate | Taxed per your income slab |

Building Your Investment Portfolio: Beginner to Advanced

Understanding what is share market portfolio development requires structured progression from basic to sophisticated strategies.

Beginners should start by learning through free resources like Zerodha Varsity and NSE educational materials. Open Demat and trading accounts with reputable brokers after completing KYC requirements. Begin with blue-chip stocks and index funds while avoiding speculation.

Intermediate investors should develop analysis skills using both fundamental and technical analysis. Practice reading company filings and using charting tools. Diversify across market capitalizations and sectors with at least 5-8 different holdings.

Advanced investors can explore derivatives like options and futures for hedging. Consider international diversification through global mutual funds. Implement tax optimization strategies and review portfolios quarterly for rebalancing opportunities.

| Level | Step | Actionable Advice |

|---|---|---|

| Beginner | Learn via free resources (Zerodha Varsity/NSE) | Read, watch, and start small |

| Open Demat/trading account, complete KYC | Choose top broker, verify credentials | |

| Start with bluechip stocks, avoid speculation | Make first investments in Quality Index funds, ETFs | |

| Intermediate | Develop analysis skills, use both FA/TA | Practice reading company filings, use charting tools |

| Diversify across market caps and sectors | At least 5–8 shares/funds | |

| Advanced | Add derivatives, international assets | Options/Futures for hedging, global MFs for diversification |

| Tax optimize, review portfolio quarterly | Rebalance, harvest gains/losses for tax efficiency |

The Power of Compounding in Share Market

Understanding what is share market compounding reveals the most powerful wealth-building force available to investors. Compounding means earning returns on your returns, where reinvested dividends and capital appreciation create exponential wealth growth over time.

Regular SIPs and dividend reinvestment can transform small monthly amounts into considerable fortunes over decades. The earlier you begin investing, the greater your final wealth accumulation due to the extended time horizon for compounding effects.

A ₹10,000 monthly SIP earning 12% annual returns can grow to ₹76 lakhs in 20 years and ₹3.5 crores in 30 years, demonstrating the extraordinary power of starting early and staying consistent with your investments.

| Investment Amount (Monthly) | Years | Expected Return (12%) | Future Value |

|---|---|---|---|

| ₹5,000 | 10 | 12% annually | ₹11 Lakhs |

| ₹10,000 | 20 | 12% annually | ₹76 Lakhs |

| ₹10,000 | 30 | 12% annually | ₹3.5 Crores |

Benefits and Wealth Creation Potential

The share market offers numerous advantages over traditional investment avenues when considering what is share market benefits for wealth building.

Capital appreciation provides the primary wealth-building mechanism, where well-selected stocks held for 5-10 years can generate returns significantly exceeding inflation rates. Historical data demonstrates consistent outperformance over traditional instruments like fixed deposits and real estate.

Superior liquidity allows investors to convert holdings to cash relatively quickly during market hours, providing flexibility for changing financial needs. Average daily trading volumes ensure efficient buying and selling of most stocks.

| Investment Benefit | Share Market | Traditional Investments |

|---|---|---|

| Liquidity | High (same-day conversion) | Low (weeks to months) |

| Growth Potential | High (15-20% annually) | Low (6-8% annually) |

| Inflation Protection | Excellent | Poor to moderate |

| Diversification Options | Extensive | Limited |

Regulatory Framework and Investor Protection

Understanding what is share market regulation helps investors appreciate the safety mechanisms protecting their investments.

The Securities and Exchange Board of India (SEBI) serves as the primary regulator, ensuring market integrity and investor protection. Established in 1992, SEBI possesses comprehensive powers to maintain fair trading practices through monitoring, enforcement, and regulation of all market participants.

Indian investors enjoy comprehensive legal protections through SEBI regulations and the Securities Contract Regulation Act. These frameworks ensure transparency in corporate communications, fair pricing mechanisms, and effective grievance redressal systems.

| Regulatory Aspect | SEBI Function | Investor Benefit |

|---|---|---|

| Market Oversight | Monitor trading activities | Fair price discovery |

| Corporate Governance | Enforce disclosure norms | Transparent information |

| Broker Regulation | License and supervise | Secure transactions |

| Dispute Resolution | Grievance mechanisms | Investor protection |

Investment Strategies: Value vs Growth vs Momentum

Different approaches to understanding what is share market investment philosophies help investors align strategies with their goals and temperament.

Value investing focuses on identifying stocks trading below their intrinsic value, offering potential for substantial returns when markets recognize their true worth. This strategy emphasizes patient, research-driven investing through analysis of financial statements, cash flows, and competitive advantages.

Growth investing targets companies with above-average expansion potential, often paying premium valuations for superior business prospects. Technology companies and emerging market leaders frequently attract growth investors willing to accept higher valuations for exceptional opportunities.

Momentum strategies capitalize on market trends and price movements, requiring more active management and higher risk tolerance. These approaches can generate quick profits but demand constant monitoring and rapid decision-making.

| Strategy Type | Time Horizon | Risk Level | Required Skills | Expected Returns |

|---|---|---|---|---|

| Value Investing | Long-term (5+ years) | Medium | Financial analysis | 12-18% annually |

| Growth Investing | Medium-term (2-5 years) | High | Industry knowledge | 15-25% annually |

| Momentum Trading | Short-term (days-months) | Very High | Technical analysis | Variable |

How the Share Market Works

If you are new to the stock market, it’s important to understand how it actually works. The share market is a platform where buyers and sellers trade shares of publicly listed companies. Demand and supply play a major role in determining share prices, which can move up or down based on market activity. Every transaction takes place through regulated exchanges, ensuring transparency and fairness.

To learn the step-by-step process in detail, check out our How the Share Market Works guide.

Conclusion

The Indian share market represents a proven pathway to financial freedom when approached methodically with patience, education, and discipline. Understanding what is share market fundamentals—from basic ownership concepts to advanced portfolio strategies—equips you with the knowledge needed for successful long-term investing.

Your wealth-building journey through share market participation can transform your financial future while contributing to India’s economic growth story. Start with modest investments in quality companies, maintain diversification across asset classes, avoid emotional decision-making, and let the power of compounding work over extended time horizons.

Remember the golden principles: invest in businesses you understand, diversify your holdings appropriately, think long-term rather than seeking quick profits, stay disciplined during market volatility, and continuously educate yourself about investment opportunities and risks.

The best time to plant a tree was twenty years ago—the second-best time is today. Similarly, the best time to start investing was yesterday, but the second-best time is now. Open your Demat account with a reputable SEBI-registered broker, begin your investment journey with small amounts, and start building the foundation for long-term wealth creation that will serve you and your family for generations to come.

Whether you’re saving for retirement, children’s education, or complete financial independence, the share market can be your trusted partner in achieving these important life goals. Take the first step today, stay committed to your investment plan, and watch your wealth grow systematically through the power of equity ownership in India’s most successful companies.

FAQ

What is share market in simple words?

The share market is a place where people buy and sell small parts (shares) of companies. When you buy a share, you own a piece of that company and can earn money if the company grows or sells shares for more than you paid. Companies use the share market to raise money to grow their business. It connects buyers and sellers of shares.

Can I invest 10 rs in share market?

Yes, you can invest ₹10 in the share market, as there is no fixed minimum amount required. However, your investment amount must cover the stock price and any applicable charges.

What are the 4 types of share market?

The 4 types of share markets are:

1) Primary Market – where companies issue new shares to raise capital.

2) Secondary Market – where existing shares are traded between investors.

3) Over-the-Counter (OTC) Market – decentralized market where shares are traded directly between parties.

4) Stock Exchange Market – organized platform where shares are listed and traded publicly.

How can I start trading?

To start trading: Choose a reputable broker, open and fund a trading account, learn the basics of the market, and start trading with a small amount while managing your risk.

Which type of share is best?

There is no single “best” type of share; it depends on your investment goals: common shares offer voting rights and growth potential, while preferred shares provide priority dividends and lower risk.

What is IPO?

An IPO (Initial Public Offering) is when a private company sells its shares to the public for the first time to raise capital and become a publicly traded company.

What is nifty and sensex?

Nifty is the benchmark index of the National Stock Exchange (NSE) that tracks the top 50 companies by market capitalisation. Sensex is the benchmark index of the Bombay Stock Exchange (BSE) that tracks the top 30 largest and most traded companies. Both serve as key indicators of the Indian stock market’s performance.

What is SIP?

SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly in mutual funds, helping investors build wealth over time through disciplined and periodic investments. It allows investing small amounts at set intervals, reducing risk by averaging the purchase cost and benefiting from compounding.

What is a stock?

A stock is a security that represents ownership of a fraction of a corporation. Owning a stock means you own a part of that company and may share in its profits.

Is IPO good or bad?

An IPO can offer early investment opportunities and potential gains, but it also carries significant risks and price volatility. Whether it is good or bad depends on careful research and individual risk tolerance.

Is SIP 100% safe?

No, SIPs (Systematic Investment Plans) are not 100% safe; they are subject to market risks and returns may fluctuate.

Can we buy NIFTY 50?

You cannot buy the NIFTY 50 index itself, but you can invest in it through NIFTY 50 index funds or ETFs.

How many stocks are in Sensex?

The Sensex contains 30 stocks.

What is Nifty in simple words?

Nifty is the National Stock Exchange Fifty, a stock market index in India that tracks the performance of the top 50 largest and most actively traded companies on the National Stock Exchange (NSE). It shows how well these major companies and the overall market are doing.

Can I trade with 100 rupees?

Yes, you can start trading with 100 rupees.

Can I make 1k a day trading?

Yes, it is possible but very risky and uncommon; most traders lose money rather than consistently make $1,000 a day.

Which share is high profit?

In August 2025, Max Healthcare Institute is among the highest profit shares in India, showing a reported annual growth of over 140%.

Which trading is best for beginners?

For beginners, stock trading or investing in index funds is generally considered the best and simplest way to start due to lower risks and ease of understanding.

What is sebi full form?

SEBI stands for Securities and Exchange Board of India.

What is the full form of Nifty?

The full form of Nifty is “National Stock Exchange Fifty.” It is a benchmark index representing the top 50 companies listed on the National Stock Exchange of India.

What is a stock?

A stock is a security that represents ownership of a fraction of a corporation. It gives the shareholder a claim to part of the company’s assets and profits. Stocks are bought and sold on stock exchanges.

Who is the CEO of SEBI?

The CEO (Chairman) of SEBI is Tuhin Kanta Pandey.

Must Read- Complete Guide What is Share Market

Disclaimer

The information shared on Calculator Singh is for educational and informational purposes only. We are not SEBI-registered financial advisors or licensed insurance agents. Please consult a qualified financial advisor or tax professional before making any investment, insurance, or financial decisions. You are solely responsible for your financial choices — Calculator Singh will not be liable for any losses or risks arising from the use of our content.