When life throws unexpected challenges your way, what is life insurance becomes more than just a question—it becomes your family’s lifeline to financial security. In today’s unpredictable world, where economic uncertainties loom large and medical expenses skyrocket, life insurance emerges as your most trusted companion in safeguarding your loved ones’ future. This comprehensive guide will transform your understanding of life insurance, revealing how this powerful financial tool can become the cornerstone of your family’s prosperity and peace of mind.

- Understanding What Life Insurance Really Means

- Life Insurance Quick Facts

- How Life Insurance Works: The Complete Mechanism

- Life Insurance Mechanism Summary

- Comprehensive Types of Life Insurance

- Term Life Insurance: Pure Protection at Its Best

- Whole Life Insurance: Lifelong Protection with Savings

- Unit Linked Insurance Plans (ULIPs): Market-Linked Growth Potential

- Endowment Plans: Guaranteed Returns with Protection

- Types of Life Insurance Comparison

- The Profound Benefits of Life Insurance

- Financial Security for Your Loved Ones

- Debt Protection and Liability Management

- Tax Benefits and Wealth Preservation

- Key Benefits Summary

- Essential Life Insurance Riders for Enhanced Protection

- Critical Illness Rider: Protection Against Medical Emergencies

- Accidental Death Benefit Rider: Additional Protection for Unexpected Events

- Waiver of Premium Rider: Ensuring Continuity of Coverage

- Comprehensive Riders Overview

- Life Insurance Claim Process: Ensuring Smooth Settlement

- Immediate Steps After Death

- Documentation Requirements

- Claim Processing and Settlement

- Claim Process Timeline

- Determining Your Optimal Life Insurance Coverage

- The D.I.M.E. Formula for Coverage Calculation

- Human Life Value (HLV) Approach

- Age-Based Coverage Guidelines

- Coverage Calculation Guide

- Factors Affecting Life Insurance Premiums

- Age and Gender Impact

- Health and Lifestyle Factors

- Occupational and Financial Factors

- Premium Factors Impact

- Who Needs Life Insurance: Comprehensive Assessment

- Primary Breadwinners and Income Earners

- Parents with Dependent Children

- Homeowners with Mortgage Obligations

- Business Owners and Entrepreneurs

- Life Insurance Needs by Category

- Your Path to Financial Security Starts Today

- Frequently Asked Questions About Life Insurance

- Disclaimer

Understanding What Life Insurance Really Means

What is life insurance? At its core, life insurance represents a sacred promise between you and an insurance company—a commitment that transcends life itself. This contractual agreement ensures that when life’s ultimate uncertainty strikes, your family receives a predetermined sum of money, known as the death benefit, providing them with the financial stability they desperately need during their most vulnerable moments.

Life insurance functions as a sophisticated risk management tool that transforms the devastating financial impact of losing a breadwinner into manageable, structured support. When you purchase a life insurance policy, you’re essentially creating a financial safety net that catches your family when they fall, ensuring they can maintain their standard of living, pursue their dreams, and honor your memory without the burden of financial stress.

The fundamental principle underlying life insurance revolves around the concept of risk pooling, where thousands of policyholders collectively contribute premiums to create a vast fund. This fund provides the necessary resources to pay death benefits to beneficiaries of deceased policyholders, making it possible for relatively small, regular premium payments to generate substantial financial protection.

Life Insurance Quick Facts

| Aspect | Key Information |

|---|---|

| Definition | Contract providing financial protection to beneficiaries |

| Premium Eligibility | Tax deduction up to ₹1.5 lakh under Section 80C |

| Death Benefit | Generally tax-free under Section 10(10D) |

| Coverage Rule | 10-15 times annual income recommended |

| Minimum Age | 18 years for most policies |

| Maximum Age | Up to 65-99 years depending on policy type |

How Life Insurance Works: The Complete Mechanism

Understanding how life insurance operates requires grasping its multifaceted structure and the intricate relationships between all stakeholders involved. The process begins with your application, where you provide detailed information about your age, health status, lifestyle habits, occupation, and financial circumstances.

Based on this comprehensive assessment, insurance companies employ sophisticated underwriting processes to evaluate your risk profile. Actuaries analyze statistical data, mortality tables, and risk factors to determine your premium—the regular payment you’ll make to keep your policy active. This scientific approach ensures that premiums accurately reflect the level of risk you represent to the insurance company.

Once your policy becomes active, you enter into a long-term commitment where your consistent premium payments maintain your coverage. During this period, your policy accumulates value and benefits according to its specific terms and conditions. If death occurs while your policy remains active, your designated beneficiaries receive the death benefit, which can be structured as a lump sum payment, regular installments, or a combination of both.

The beauty of life insurance lies in its predictability and reliability. Unlike other financial instruments subject to market volatility, life insurance provides guaranteed benefits that your family can depend upon during their darkest hours.

Life Insurance Mechanism Summary

| Stage | Process | Timeline |

|---|---|---|

| Application | Medical exams, documentation, underwriting | 15-30 days |

| Premium Payment | Regular payments to maintain coverage | Monthly/Annual |

| Claim Initiation | Notification of death to insurer | Immediate |

| Document Submission | Death certificate, policy documents | Within 30 days |

| Claim Settlement | Benefit payout to beneficiaries | 15-45 days |

Comprehensive Types of Life Insurance

Term Life Insurance: Pure Protection at Its Best

Term life insurance stands as the most straightforward and affordable form of life protection, designed specifically for individuals seeking maximum coverage at minimum cost. This pure protection plan provides substantial death benefits for predetermined periods—typically 10, 20, or 30 years—without any savings or investment components. The primary advantage of term insurance lies in its remarkable affordability, allowing young families and individuals to secure significant coverage amounts that would be prohibitively expensive under other policy types. For example, a healthy 30-year-old non-smoker can secure ₹1 crore coverage for approximately ₹700-₹1,200 per month, making it accessible to middle-class families across India.

Term insurance policies offer various payout options, including lump sum payments, regular income streams, or hybrid combinations that provide both immediate relief and long-term financial support. Many term policies also include conversion options, allowing policyholders to transform their temporary coverage into permanent protection without undergoing additional medical examinations.

Whole Life Insurance: Lifelong Protection with Savings

Whole life insurance represents the epitome of comprehensive financial protection, combining lifelong coverage with systematic wealth accumulation. These policies remain active until age 99 or 100, guaranteeing that beneficiaries will eventually receive death benefits regardless of when death occurs.

The distinguishing feature of whole life insurance lies in its cash value component, which grows steadily over time through guaranteed interest rates set by the insurance company. This accumulated cash value serves multiple purposes: it can be borrowed against during emergencies, withdrawn for major expenses, or used to pay future premiums.

Whole life policies command higher premiums than term insurance due to their dual nature of providing both protection and savings. However, they offer unmatched stability and predictability, making them ideal for individuals seeking guaranteed returns and estate planning benefits.

Unit Linked Insurance Plans (ULIPs): Market-Linked Growth Potential

ULIPs represent the modern evolution of life insurance, seamlessly blending protection with market-linked investment opportunities. These sophisticated financial products allocate your premiums between life coverage and professionally managed investment funds, offering the potential for substantial wealth creation over time.

The investment component of ULIPs provides access to equity funds, debt funds, and hybrid funds, allowing policyholders to customize their investment strategy according to their risk tolerance and financial goals. With a mandatory five-year lock-in period, ULIPs encourage disciplined long-term investing while providing the flexibility to switch between funds as market conditions change.

ULIPs offer remarkable transparency, with regular updates on fund performance and clear disclosure of all charges. This transparency, combined with professional fund management, makes ULIPs attractive for individuals seeking market-linked returns while maintaining essential life protection.

Endowment Plans: Guaranteed Returns with Protection

Endowment policies occupy a unique position in the life insurance landscape, offering guaranteed maturity benefits alongside comprehensive life protection. These traditional savings plans provide assured returns through bonuses and guaranteed maturity benefits, making them ideal for risk-averse investors seeking predictable outcomes.

The dual benefit structure of endowment plans ensures that policyholders receive substantial maturity benefits if they survive the policy term, while their beneficiaries receive death benefits if the policyholder dies during the coverage period. This guarantee of benefits, regardless of circumstances, provides unparalleled peace of mind.

Endowment plans typically offer bonus allocations—additional amounts added to the policy’s value based on the insurance company’s investment performance. These bonuses, once declared, become guaranteed additions to your policy’s value, enhancing your overall returns.

Types of Life Insurance Comparison

| Type | Coverage Duration | Premium Level | Cash Value | Best For |

|---|---|---|---|---|

| Term Life | 10-30 years | Lowest | None | Young families |

| Whole Life | Lifetime | Higher | Yes | Estate planning |

| ULIPs | Long-term | Moderate | Market-linked | Wealth creation |

| Endowment | Fixed term | Moderate-High | Guaranteed | Conservative savers |

The Profound Benefits of Life Insurance

Financial Security for Your Loved Ones

The primary benefit of life insurance transcends mere monetary compensation—it represents the continuation of your love, care, and responsibility even after you’re gone. When the unthinkable happens, life insurance ensures your family doesn’t face the dual trauma of emotional loss and financial devastation.

Life insurance provides comprehensive income replacement, allowing your family to maintain their current lifestyle, continue living in their home, and pursue their educational and career goals without compromise. This financial stability becomes particularly crucial during the initial grieving period when family members may be unable to work or make major financial decisions. The death benefit from life insurance can cover immediate expenses such as funeral costs, medical bills, and outstanding debts, while also providing long-term support for everyday living expenses, children’s education, and your spouse’s retirement needs. This comprehensive coverage ensures that your family’s financial security remains intact during their most vulnerable period.

Debt Protection and Liability Management

Modern families often carry significant debt burdens, including home loans, personal loans, credit card balances, and educational loans. Without proper protection, these debts can become overwhelming burdens for surviving family members, potentially forcing them to liquidate assets or compromise their standard of living.

Life insurance serves as a powerful debt elimination tool, providing sufficient funds to clear all outstanding obligations immediately. This debt clearance not only removes financial stress but also preserves family assets, ensuring that properties, investments, and savings remain available for your family’s ongoing needs rather than being sacrificed to pay off debts.

The peace of mind that comes from knowing your family won’t inherit your debts cannot be overstated. This protection allows your loved ones to grieve properly without the additional stress of financial obligations, enabling them to focus on healing and moving forward with their lives.

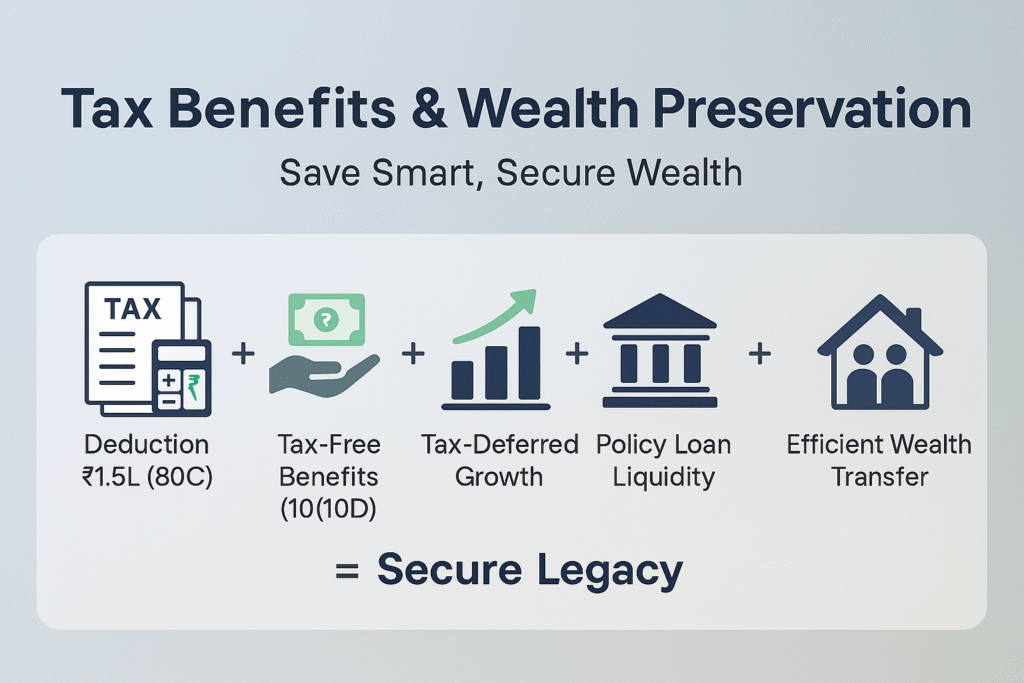

Tax Benefits and Wealth Preservation

Life insurance offers exceptional tax advantages that enhance its value as a financial planning tool. Under Section 80C of the Income Tax Act, 1961, premiums paid toward life insurance policies qualify for tax deductions up to ₹1.5 lakh annually, significantly reducing your taxable income.

The tax benefits extend to policy proceeds as well, with death benefits generally being tax-free under Section 10(10D) of the Income Tax Act. This tax-free nature of death benefits means your beneficiaries receive the full policy amount without any deduction for taxes, maximizing the financial support available to them.

For permanent life insurance policies with cash value components, the growth in cash value occurs on a tax-deferred basis, allowing your wealth to compound without annual tax implications. This tax efficiency makes life insurance an attractive complement to other investment vehicles in your overall financial portfolio.

Key Benefits Summary

| Benefit Category | Specific Advantages | Tax Implications |

|---|---|---|

| Financial Protection | Income replacement, debt coverage | Death benefit tax-free |

| Immediate Relief | Funeral costs, medical bills | No tax on claim amount |

| Long-term Support | Education funding, retirement | Growth tax-deferred |

| Premium Benefits | Tax deduction up to ₹1.5L | Reduces taxable income |

| Estate Planning | Wealth transfer, legacy creation | Efficient asset transfer |

Essential Life Insurance Riders for Enhanced Protection

Life insurance riders represent additional layers of protection that can be added to your base policy for enhanced coverage at affordable rates. These optional benefits address specific risks and circumstances that your basic policy might not fully cover, providing comprehensive protection tailored to your unique needs.

Critical Illness Rider: Protection Against Medical Emergencies

Critical illness riders provide substantial financial support when you’re diagnosed with serious medical conditions such as cancer, heart attack, stroke, kidney failure, or major organ transplants. Upon diagnosis and completion of the survival period, this rider pays a lump sum amount that can be used for treatment costs, lifestyle modifications, or income replacement during recovery.

The financial burden of critical illnesses extends far beyond immediate medical expenses, often requiring long-term lifestyle changes, specialized care, and loss of income during treatment and recovery. Critical illness riders ensure that such diagnoses don’t devastate your family’s finances while providing the resources needed for optimal treatment and care.

Modern critical illness riders cover an extensive range of conditions, with some policies covering up to 64 different critical illnesses. This comprehensive coverage ensures protection against both common and rare serious medical conditions that could otherwise create financial havoc.

Accidental Death Benefit Rider: Additional Protection for Unexpected Events

Accidental death benefit riders provide additional death benefits if your death occurs due to an accident, typically paying double the base sum assured. This enhanced protection recognizes that accidental deaths often occur during prime earning years and may leave families with additional financial challenges.

The definition of accidental death under these riders is comprehensive, covering various scenarios including road accidents, drowning, burns, falls, and other unforeseen circumstances. However, exclusions typically apply to deaths resulting from suicide, war, self-inflicted injuries, or deaths under the influence of alcohol or drugs.

Accidental death riders are particularly valuable for individuals in high-risk occupations or those who frequently travel, providing additional peace of mind at relatively modest additional premiums.

Waiver of Premium Rider: Ensuring Continuity of Coverage

Waiver of premium riders eliminate the burden of premium payments if you become disabled or are diagnosed with a critical illness, ensuring your policy remains active without financial strain. This rider is particularly valuable because it maintains your life insurance protection precisely when you might be least able to afford the premiums.

The waiver typically applies to total and permanent disability or specified critical illnesses, with the insurance company continuing to pay all future premiums while keeping your policy benefits intact. This continuation ensures that your family’s protection remains uncompromised even if your income-earning capacity is severely impacted.

Comprehensive Riders Overview

| Rider Type | Coverage Provided | Typical Cost | Key Benefits |

|---|---|---|---|

| Critical Illness | Major disease diagnosis | 2-5% of base premium | Lump sum payout |

| Accidental Death | Death due to accidents | 1-2% of base premium | Double death benefit |

| Disability | Permanent/partial disability | 3-4% of base premium | Income replacement |

| Waiver Premium | Premium waiver on disability | 2-3% of base premium | Policy continuation |

| Hospital Cash | Hospitalization expenses | 1-2% of base premium | Daily cash benefit |

Life Insurance Claim Process: Ensuring Smooth Settlement

Understanding the life insurance claim process empowers your family to navigate this challenging period with confidence and efficiency. The claim settlement process, while straightforward, requires careful attention to documentation and timing to ensure swift processing.

Immediate Steps After Death

The first crucial step involves immediate notification to the insurance company about the policyholder’s death. This notification can be made through multiple channels including phone calls, emails, online portals, or visits to branch offices. Most insurers provide 24/7 claim intimation services to accommodate emergency situations.

During the initial notification, basic information such as the policy number, policyholder’s name, date of death, and preliminary cause of death should be provided. This information helps the insurer initiate the claim process and guide the family through subsequent steps.

Following notification, the insurer typically assigns a claims officer who becomes the primary point of contact for the family, providing guidance and support throughout the settlement process. This personalized assistance helps ensure that all requirements are clearly understood and properly fulfilled.

Documentation Requirements

Comprehensive documentation forms the foundation of successful claim settlement. The standard documentation includes the original policy document, death certificate issued by local authorities, completed claim forms provided by the insurer, and valid identification documents for the claimant.

For natural deaths, additional medical documentation may be required, including medical cause of death certificates and treatment records from hospitals or physicians. These documents help establish the medical circumstances surrounding the death and verify the legitimacy of the claim.

In cases of unnatural deaths including accidents, suicides, or murders, additional documentation becomes necessary. This typically includes police reports such as the First Information Report (FIR), post-mortem reports, inquest reports, and final police investigation reports.

Claim Processing and Settlement

Once complete documentation is submitted, insurers typically process straightforward claims within 15 days. However, claims requiring investigation due to policy terms or circumstances surrounding the death may take up to 45 days for final settlement.

During the processing period, insurers conduct thorough verification of all submitted documents and may seek additional clarification or documentation if necessary. This verification process, while sometimes lengthy, ensures that legitimate claims are honored while preventing fraudulent activities.

Upon successful verification, the death benefit is disbursed to the designated beneficiaries through electronic fund transfer or demand drafts. Most insurers provide regular updates throughout the process, keeping beneficiaries informed about the claim status and any additional requirements.

Claim Process Timeline

| Stage | Required Actions | Typical Duration | Key Requirements |

|---|---|---|---|

| Notification | Contact insurer immediately | Same day | Policy number, basic details |

| Documentation | Submit required documents | Within 30 days | Death certificate, forms |

| Verification | Insurer reviews documents | 15-45 days | Additional clarification if needed |

| Settlement | Benefit payment processed | 2-7 days | Bank account details |

Determining Your Optimal Life Insurance Coverage

Calculating the appropriate amount of life insurance coverage requires careful analysis of your financial responsibilities, future obligations, and family’s long-term needs. The coverage amount should provide sufficient funds to replace your income, clear all debts, fund your children’s education, and maintain your family’s lifestyle for an extended period.

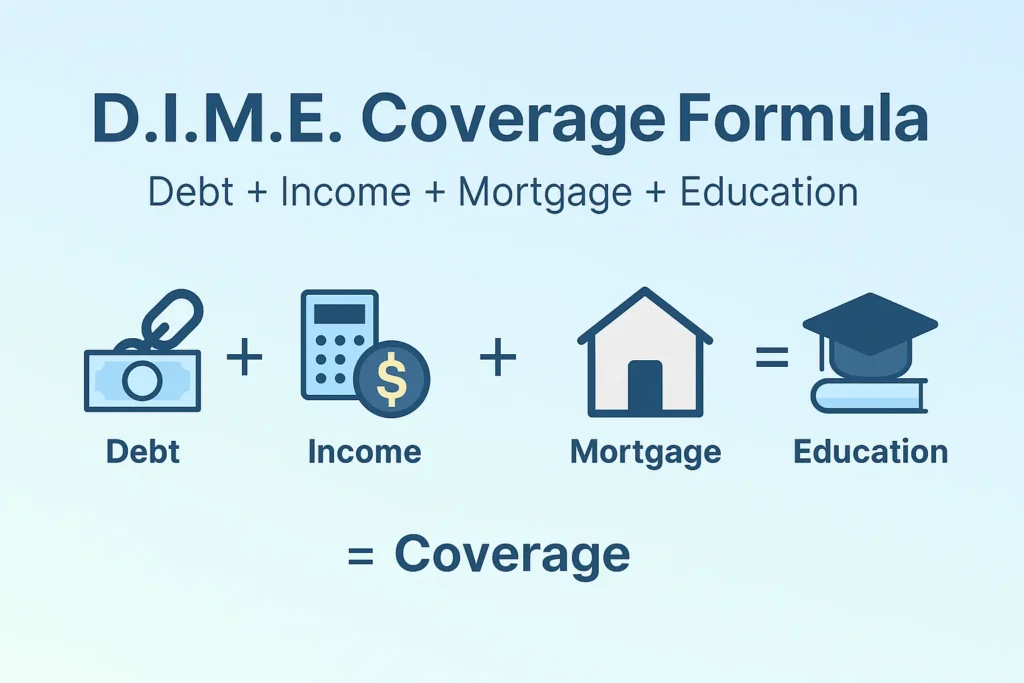

The D.I.M.E. Formula for Coverage Calculation

The D.I.M.E. formula provides a systematic approach to determining your life insurance needs by addressing four critical financial areas. “D” represents your total debts including credit card balances, personal loans, and other outstanding obligations that your family shouldn’t inherit. “I” stands for income replacement, typically calculated as 10-15 times your annual income to ensure your family’s ongoing financial security.

“M” addresses your mortgage and home loan obligations, ensuring your family can remain in their home without financial stress. “E” covers education expenses for your children, including primary, secondary, and higher education costs that may extend well into the future.

By adding these four components together, you arrive at a comprehensive coverage amount that addresses all major financial obligations and provides adequate income replacement. This methodical approach ensures that no critical financial need is overlooked in your coverage planning.

Human Life Value (HLV) Approach

The Human Life Value approach focuses on the economic worth of your life by calculating the present value of your future earnings. This sophisticated method considers your current age, expected retirement age, annual income, expected income growth, inflation rates, and discount rates to determine your economic value to your family.

HLV calculations provide a more nuanced assessment of your insurance needs by accounting for the time value of money and your increasing earning potential over time. This approach is particularly valuable for young professionals whose earning capacity is expected to grow significantly throughout their careers.

The HLV method also considers your annual expenses, ensuring that the insurance calculation reflects your net contribution to the family’s financial well-being rather than your gross income. This refinement provides a more accurate assessment of the actual financial support your family would lose.

Age-Based Coverage Guidelines

Life insurance needs evolve significantly as you progress through different life stages, requiring periodic reassessment and adjustment of coverage amounts. Young adults in their 20s and early 30s typically need 20-25 times their annual income to account for long protection periods and growing financial responsibilities.

Middle-aged individuals between 35-45 years generally require 15-20 times their annual income, as their earning potential has stabilized and their protection period has shortened. This life stage often coincides with peak financial responsibilities including home loans, children’s education, and aging parents’ care.

Individuals approaching retirement (50-60 years) typically need 10-15 times their annual income, focusing primarily on clearing remaining debts, completing children’s education, and providing for their spouse’s long-term security. The reduced coverage need reflects the shorter protection period and reduced financial obligations.

Coverage Calculation Guide

| Life Stage | Income Multiplier | Primary Focus Areas | Special Considerations |

|---|---|---|---|

| 20-35 years | 20-25x annual income | Career building, home purchase | Growing income potential |

| 35-45 years | 15-20x annual income | Children’s education, peak earning | Maximum responsibility period |

| 45-55 years | 12-18x annual income | Debt clearance, retirement planning | Declining obligations |

| 55+ years | 8-12x annual income | Spouse security, estate planning | Reduced protection needs |

Factors Affecting Life Insurance Premiums

Life insurance premiums are calculated using sophisticated actuarial models that assess various risk factors to determine the appropriate cost for your coverage. Understanding these factors helps you make informed decisions about your policy and potentially reduce your premium costs through lifestyle modifications and strategic planning.

Age and Gender Impact

Age represents the most significant factor in premium calculation, with younger individuals enjoying substantially lower premiums due to lower mortality risk. Insurance companies use detailed mortality tables that show how death rates increase with age, resulting in exponentially higher premiums for older applicants.

Gender also influences premium calculations, with women typically paying lower premiums than men due to higher life expectancy statistics. This actuarial difference reflects the statistical reality that women generally live longer than men, reducing the insurance company’s risk exposure.

The compounding effect of age on premiums makes early policy purchase extremely advantageous. For example, a 25-year-old might pay ₹8,000 annually for ₹1 crore coverage, while a 35-year-old could pay ₹15,000 for the same coverage, and a 45-year-old might pay ₹30,000 or more.

Health and Lifestyle Factors

Your current health status and medical history significantly impact premium calculations. Insurance companies conduct thorough medical examinations and review medical records to assess your health risks. Pre-existing conditions such as diabetes, hypertension, heart disease, or cancer typically result in higher premiums or coverage restrictions.

Lifestyle choices profoundly affect premium rates, with smoking being the most impactful factor. Smokers typically pay 40-100% higher premiums than non-smokers due to significantly higher risks of cancer, heart disease, and respiratory problems. Similar premium increases apply to excessive alcohol consumption and participation in high-risk activities.

Regular exercise, healthy diet, and preventive healthcare can positively influence your premium rates. Many insurers offer wellness programs and premium discounts for policyholders who maintain healthy lifestyles and undergo regular health check-ups.

Occupational and Financial Factors

Your occupation plays a crucial role in premium determination, with high-risk professions such as mining, aviation, offshore work, and military service attracting higher premiums. These occupations involve inherent risks that increase the probability of accidental death or injury.

Financial factors including your income, existing insurance coverage, and debt levels are carefully evaluated to prevent over-insurance and ensure policy affordability. Insurance companies typically limit coverage to 10-20 times your annual income to maintain reasonable risk exposure.

Your policy term and coverage amount directly impact premiums, with longer terms and higher coverage amounts resulting in increased costs. However, longer terms often provide better value by locking in lower premium rates for extended periods.

Premium Factors Impact

| Factor Category | Impact Level | Premium Variation | Optimization Strategies |

|---|---|---|---|

| Age | Very High | Doubles every 10-15 years | Buy young, review regularly |

| Health Status | High | 20-200% variation | Maintain fitness, regular checkups |

| Smoking | Very High | 40-100% higher | Quit smoking, wait 12 months |

| Occupation | Moderate | 10-50% variation | Consider safer roles |

| Coverage Amount | High | Direct proportion | Optimize using calculators |

Who Needs Life Insurance: Comprehensive Assessment

Life insurance serves diverse individuals across different life stages and circumstances, making it one of the most universally relevant financial products. Understanding who benefits most from life insurance helps in making informed decisions about coverage needs and timing.

Primary Breadwinners and Income Earners

Individuals who serve as primary income sources for their families represent the most obvious candidates for life insurance. When a family’s financial stability depends heavily on one person’s earnings, that individual’s death could create devastating financial consequences for surviving family members.

Primary breadwinners should consider substantial coverage amounts—typically 10-20 times their annual income—to ensure their families can maintain their current lifestyle without the primary income. This coverage should account for immediate expenses, ongoing living costs, debt obligations, and long-term financial goals such as children’s education and retirement planning.

The coverage needs of primary breadwinners extend beyond mere income replacement to include protection for specific financial obligations such as mortgage payments, children’s education expenses, and support for aging parents. This comprehensive approach ensures that all financial dependencies are adequately addressed.

Parents with Dependent Children

Parents face unique life insurance needs due to their long-term financial responsibilities toward their children. These obligations include immediate childcare costs, educational expenses from primary school through college, extracurricular activities, healthcare needs, and support until children become financially independent.

Single parents face even greater life insurance needs as they represent the sole financial support for their children. The loss of a single parent could create immediate crises regarding childcare, housing, education funding, and basic living expenses. Life insurance provides the financial foundation necessary for guardian arrangements and continued support.

Parents should consider child-specific riders or dedicated child plans that ensure educational funding regardless of circumstances. These specialized coverages can guarantee that children’s educational dreams remain achievable even if parents aren’t there to provide direct financial support.

Homeowners with Mortgage Obligations

Homeowners carrying mortgage debt face significant life insurance needs to protect their families’ housing security. Without adequate life insurance, surviving family members might be forced to sell the family home to manage mortgage payments, creating additional trauma during an already difficult period.

Mortgage life insurance or term coverage equal to the outstanding loan balance ensures that the family home remains secure. This protection allows surviving family members to remain in familiar surroundings while grieving and adjusting to their new circumstances.

Homeowners should consider decreasing term insurance that mirrors their mortgage balance decline over time, providing optimal protection at reasonable costs. This approach ensures adequate coverage while avoiding over-insurance as mortgage obligations decrease.

Business Owners and Entrepreneurs

Business owners face complex life insurance needs encompassing both personal family protection and business continuity requirements. The death of a key business owner can disrupt operations, affect customer relationships, and potentially force business closure or distress sales.

Key person insurance protects businesses against the financial impact of losing critical individuals, providing funds for recruitment, training, business stabilization, and debt management during transition periods. This protection ensures business survival and employee job security following the owner’s death.

Buy-sell agreements funded by life insurance enable smooth business ownership transitions, allowing surviving partners to purchase the deceased’s business interest at predetermined valuations. This arrangement prevents forced business liquidation and protects both family and business interests.

Life Insurance Needs by Category

| Category | Primary Needs | Recommended Coverage | Special Considerations |

|---|---|---|---|

| Primary Earners | Income replacement | 10-20x annual income | Debt clearance, lifestyle maintenance |

| Parents | Child support, education | 15-25x income + education costs | Long-term responsibility period |

| Homeowners | Mortgage protection | Outstanding loan balance | Property security for family |

| Business Owners | Personal + business needs | Multiple policies | Key person + buy-sell coverage |

| Single Parents | Complete child support | Maximum affordable coverage | Guardian funding arrangements |

Your Path to Financial Security Starts Today

As you stand at the crossroads of financial planning, remember that what is life insurance represents far more than a mere financial product—it embodies your love, responsibility, and commitment to your family’s future prosperity. In a world where uncertainties multiply daily and financial challenges grow more complex, life insurance emerges as your most reliable ally in creating lasting security and peace of mind.

The comprehensive exploration we’ve undertaken reveals life insurance as a multifaceted financial instrument capable of addressing diverse needs, from basic protection to sophisticated wealth creation strategies. Whether you’re a young professional just starting your career, a parent nurturing growing children, or an experienced individual planning your legacy, life insurance offers customized solutions that evolve with your changing circumstances.

The time for action is now. Every day you delay purchasing adequate life insurance coverage is a day your family remains vulnerable to financial uncertainty. The remarkable affordability of term insurance, the wealth-building potential of permanent policies, and the comprehensive protection offered by modern insurance products make this decision both logical and urgent.

Take the first step toward securing your family’s future by consulting with qualified insurance professionals, utilizing online calculators to determine your optimal coverage needs, and comparing policies from reputable insurers with strong claim settlement ratios. Your family’s financial security and your own peace of mind depend on the decisions you make today—make them count, make them comprehensive, and make them now.

Frequently Asked Questions About Life Insurance

What is life insurance in simple words?

Life insurance is a contract where an insurer, in exchange for premiums, pays a lump sum (death benefit) to named beneficiaries if the insured person dies, providing financial protection for loved ones.

What does life insurance do?

Life insurance is a contract that pays a tax-free lump sum (the death benefit) to designated beneficiaries when the insured person dies, helping replace lost income and cover expenses like debts, living costs, and funeral costs.

What are the three types of life insurance?

Term life, whole life, and universal life.

What are the types of insurance?

The two broad types are: Life insurance and General (non-life) insurance.

What is the full form of IRDA?

Insurance Regulatory and Development Authority of India.

What is the age limit for life insurance?

Most insurers allow new life insurance entry from age 18 up to about 60–65; some plans extend entry to around 70 and coverage maturity to 80–99/100, depending on the policy.

What is the best age to get life insurance?

The best age to get life insurance is when young—ideally in the 20s or early 30s—so premiums are lower and coverage is easier to qualify for.

Can a 70 year old have life insurance?

Yes—many insurers offer life insurance to people at age 70, though entry limits often range up to 65–70 and sometimes higher depending on the plan and insurer.

What type of life insurance is best?

For most people, the best choice is term life insurance because it provides adequate coverage at the lowest cost; permanent policies (like whole life) suit those needing lifelong coverage and cash value, but they’re far more expensive.

Who should buy life insurance?

Anyone with financial dependents or shared debts—such as income earners, stay‑at‑home spouses, parents, homeowners with loans, or business owners—should consider life insurance to protect beneficiaries and replace lost income if they die.

When should a person start thinking about life insurance?

Start once anyone depends on the person’s income or debts would burden survivors, and earlier is cheaper—typically beginning in early working years (20s–30s).

Which company has the best term life insurance?

There’s no single “best” insurer; per IRDAI’s latest claim-settlement data, leaders include Max Life and HDFC Life with industry-high settlement ratios, making them among the most reliable for term cover.

What happens if you live longer than term life insurance?

If you outlive a standard term life policy, coverage ends and there’s no payout or refund; only “return of premium” term plans pay back premiums if selected in advance.

What to know before buying life insurance?

Decide how much coverage is needed and for how long, understand the policy type (term vs. cash value), verify the insurer’s financial strength and authorization, ensure premiums are affordable now and if they rise, answer the application truthfully, and read the policy carefully before signing and replacing any existing coverage.

Who is the most trusted insurance company?

LIC (Life Insurance Corporation of India) is the most trusted insurance brand among Indians, consistently ranking at the top in nationwide trust studies and brand-strength reports.

Which is better LIC or SBI life insurance?

Neither is universally “better”; per IRDAI FY2023–24 data, LIC settled 96.42% of individual death claims within 30 days while SBI Life settled 98.99%, so SBI Life was faster on this metric, but the right choice depends on personal needs and plan features.

What is the cheapest full coverage insurance?

Travelers currently offers the cheapest widely available full-coverage car insurance among large U.S. insurers, at about $148 per month on average, while USAA is lower for eligible military families.

What is the cheapest full coverage insurance?

There is no single “cheapest” full coverage in India because comprehensive (full) premiums vary by car, location, IDV, and add-ons; only third-party rates are standardized by IRDAI, while comprehensive prices must be compared across insurers to find the lowest for a given vehicle and profile.

What is the minimum age to buy life insurance?

Most insurers allow purchases from age 18, with some policies available from age 21. The maximum entry age typically ranges from 60-65 years depending on the policy type.

Can I buy life insurance for my spouse or children?

Yes, you can purchase life insurance for immediate family members provided you have insurable interest. You must be able to demonstrate that their death would cause you financial hardship.

Is a medical examination always required?

Medical exams are typically required for higher coverage amounts, older applicants, or those with health concerns. Some policies offer simplified underwriting with health questionnaires only.

Can I change my beneficiary after buying the policy?

Yes, most policies allow beneficiary changes at any time during the policy term unless the policy has been assigned or is under legal constraints.

What happens if I stop paying premiums?

Term policies lapse immediately if premiums aren’t paid within the grace period. Permanent policies with cash value may continue using accumulated value to pay premiums automatically.

Are suicide claims covered under life insurance?

Most policies include a suicide clause excluding coverage for suicide within the first 1-2 years. After this period, suicide claims are generally covered.

Can I take a loan against my life insurance policy?

Permanent life insurance policies with cash value typically allow policy loans. The loan amount depends on the accumulated cash value and policy terms.

How does inflation affect my life insurance coverage?

Fixed coverage amounts lose purchasing power over time due to inflation. Consider policies with increasing coverage options or periodic coverage reviews to maintain adequate protection.

Disclaimer

The information shared on Calculator Singh is for educational and informational purposes only. We are not SEBI-registered financial advisors or licensed insurance agents. Please consult a qualified financial advisor or tax professional before making any investment, insurance, or financial decisions. You are solely responsible for your financial choices — Calculator Singh will not be liable for any losses or risks arising from the use of our content.