Introduction

When thinking about your family’s future, no thought is more important than securing their financial well-being if something unexpected happens. what is term insurance offers a straightforward way to ensure that those you love can maintain their lifestyle, settle outstanding debts, and meet long-term goals even in your absence. This guide dives deep into every aspect of term insurance, providing clear explanations, real-world examples, and actionable insights so you can choose the right plan with confidence.

What Is Term Insurance?

Term insurance is a pure protection policy that provides a guaranteed death benefit for a fixed duration in exchange for regular premium payments. Unlike permanent life insurance, term plans focus solely on risk coverage without any investment or cash value component. If the policyholder passes away during the chosen term, the insurer pays the agreed sum assured to the nominee, helping the family meet financial needs immediately and over the long term.

How Term Insurance Works

Term insurance functions through a simple contractual agreement between you and the insurer. First, you select the policy term—commonly 10, 15, 20, or 30 years—and the sum assured that suits your family’s needs. Next, you provide personal, health, and lifestyle details during the application process. Once your policy is issued, you pay the fixed premiums on schedule. If an untimely death occurs during the policy tenure, your beneficiaries receive the lump-sum payout tax-free under Section 10(10D) of the Income Tax Act, securing financial stability for your loved ones.

Types of Term Insurance

There are several term plan variants designed to match different financial objectives:

- Level Term Insurance: Fixed premium and sum assured throughout the term.

- Decreasing Term Insurance: Sum assured decreases over time, often aligned with a reducing home loan balance.

- Increasing Term Insurance: Sum assured increases annually at a predetermined rate to combat inflation.

- Return of Premium (ROP) Term Insurance: Premiums paid are refunded if the policyholder survives the term, combining protection with return benefits.

Who Should Consider Term Insurance

Term insurance suits a wide range of individuals seeking affordable protection:

- Young Professionals entering the workforce who want high coverage at minimal cost.

- Married Couples needing to secure children’s education and household expenses.

- Self-Employed Individuals who lack employer-provided group life cover.

- Loan Borrowers to ensure outstanding debts do not burden one’s family.

- Taxpayers seeking to leverage deductions under Section 80C while protecting loved ones.

Key Benefits of Term Insurance

Term plans deliver several compelling advantages:

- Pure Protection: Entire premium goes towards risk coverage, maximizing death benefit per rupee spent.

- Affordability: Lower cost compared to endowment or unit-linked plans.

- Flexibility: Choose tenure, sum assured, premium payment frequency, and add riders for critical illness or accidental disability.

- Tax Savings: Premiums qualify for deductions up to ₹1.5 lakh per annum, and death benefits are tax-exempt.

Premium Determination and Add-Ons

Insurers calculate term premiums based on age, health status, lifestyle habits, and coverage amount. Younger, healthier individuals pay significantly lower rates. Many plans offer optional riders, such as critical illness coverage, accidental death benefit, and premium waiver on disability, allowing you to tailor protection to your unique risks and goals.

| Factor | Influence on Premium |

|---|---|

| Age | Younger entrants enjoy lower rates |

| Health & Habits | Non-smokers and those with no pre-existing conditions receive preferred pricing |

| Coverage Amount | Higher sums assured result in proportionally higher premiums |

| Rider Selection | Each add-on increases the total premium depending on risk covered |

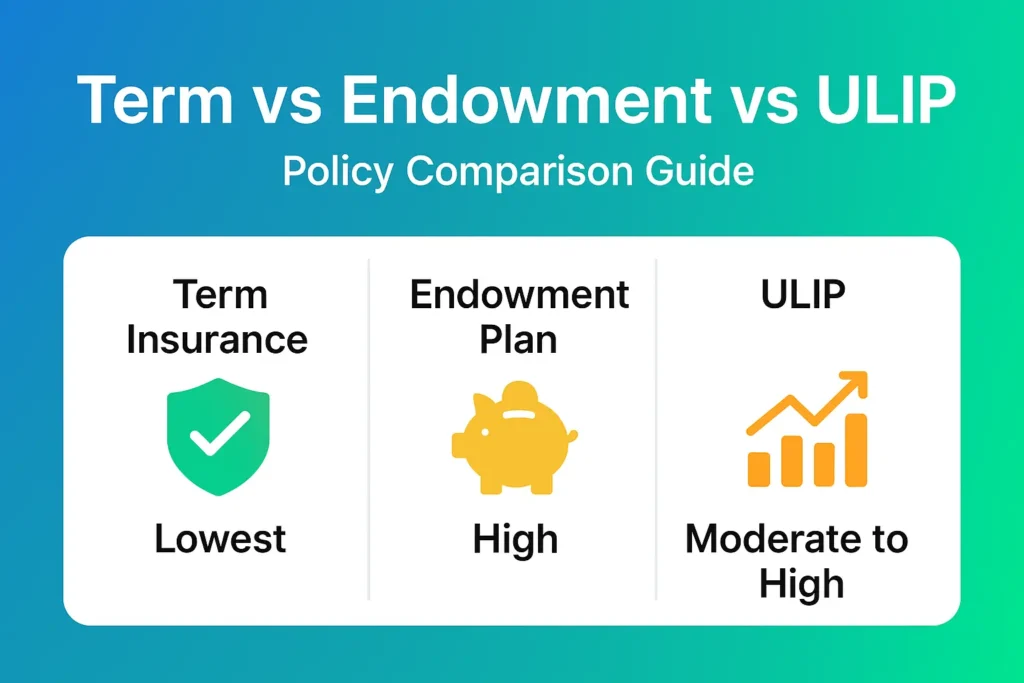

Comparing Term Insurance with Other Policies

Unlike permanent life products, term insurance focuses exclusively on protection without any savings or investment components. Endowment plans combine coverage with maturity benefits but command much higher premiums. Unit-linked insurance plans (ULIPs) invest part of the premium in market-linked funds, exposing policyholders to investment risks. For pure life cover at the lowest cost, term insurance remains the most efficient choice.

| Policy Type | Premium Cost | Cash Value | Flexibility |

|---|---|---|---|

| Term Insurance | Lowest | None | High through riders |

| Endowment Plan | High | Guaranteed maturity | Limited risk options |

| ULIP | Moderate to High | Market-linked value | Investment-risk based |

Term insurance delivers the most efficient life cover, providing peace of mind through affordable premiums, flexible options, and robust death benefits. By understanding policy features, comparing plan variants, and selecting appropriate riders, you can secure your family’s financial future against life’s uncertainties.

Frequently Asked Questions

What is term insurance?

Term insurance is a life cover that pays a lump sum to your nominee if you pass away within the policy tenure.

Can I convert a term plan to a permanent plan?

Yes, many insurers allow conversion to whole or endowment policies without fresh medical exams at pre-specified intervals.

How is the sum assured determined?

Sum assured depends on your financial obligations, income replacement needs, and long-term goals; life cover calculators can guide your choice.

Are term insurance premiums tax deductible?

Yes, premiums qualify for deductions under Section 80C up to ₹1.5 lakh annually, and death benefits are exempt under Section 10(10D).

Can I renew my term policy after expiry?

Most plans offer renewal at prevailing premiums without health checks until a maximum age, usually 65 or 70 years.

How much term insurance cover do I need?

Experts recommend coverage of at least 10–12 times your annual income, considering inflation, family needs, liabilities, and future goals.

What happens if I survive the policy tenure?

No payout is made for standard plans. For TROP policies, you receive all premiums paid (excluding taxes and extra charges).

Does term insurance cover death due to accident or natural calamities?

Yes, term insurance covers both accidental deaths and deaths from “acts of God” like natural disasters, unless specifically excluded in the policy terms.

Are premiums fixed during the policy period?

Premiums generally remain the same throughout the term, except in increasing term plans or as stated in the policy.

Can NRIs purchase term insurance in India?

Yes, non-resident Indians (NRIs) can buy term insurance policies from Indian insurers.

What is a term insurance rider?

Riders are optional add-ons for enhanced coverage, such as critical illness, accidental death, waiver of premium, and more. They require extra premium.

Is a medical test required for buying term insurance?

Insurers often require medical tests, especially for high sum assured or for those above a certain age. The required tests depend on the coverage amount, applicant’s age, and health.

If the policyholder dies outside India, is the claim valid?

Most insurers process claims even if death occurs outside India, but the nominee must inform the insurer and provide all necessary documents. Always check policy terms.

How do I choose the right term insurance plan?

Consider claim settlement ratio of insurer, payout options (lump sum/monthly), add-on riders, affordability, and your family’s financial needs.

Disclaimer

The information shared on Calculator Singh is for educational and informational purposes only. We are not SEBI-registered financial advisors or licensed insurance agents. Please consult a qualified financial advisor or tax professional before making any investment, insurance, or financial decisions. You are solely responsible for your financial choices — Calculator Singh will not be liable for any losses or risks arising from the use of our content.